New York State Teamsters Conference

Pension & Retirement Fund

Stay Informed: Email Alerts Sign Up

New York State Teamsters Conference

Pension & Retirement Fund

Stay Informed: Email Alerts Sign Up

If the application is approved, the PPP will become effective on July 1, 2017.

The Trustees decided the terms of the PPP after many meetings and hours of considering every possible alternative. The Trustees designed the PPP on the advice of, and in consultation with the Fund’s various service providers, including actuaries, legal counsel, and investment consultants. The Trustees also received valuable input from the Retiree Representative and his independent attorneys and actuaries.

Under MPRA, a benefit reduction application must be projected to save the Fund. Based on all the actuarial and other projections, the PPA will keep the Fund solvent.

If the Fund becomes insolvent, meaning it runs out of money to pay benefits, the Pension Benefit Guaranty Corporation (“PBGC”) will begin paying benefits. However, if this happens, the Fund’s benefits would be reduced below the levels proposed in the PPP. The PBGC will only pay benefits up to a certain amount. For example, for a participant with 30 years of service, the maximum amount the PBGC would pay is $1,072.50 per month. Participants with less than 30 years of service would receive less. And, the PBGC is projected to be insolvent itself by 2025, and if the PBGC runs out of money, it means all Fund participants receive no pension benefits.

The benefit reductions proposed under the PPP are permanent, but MPRA requires the Trustees to review the Fund’s status every year to determine whether the benefit reductions are still necessary. It is possible – although unlikely – that the Fund could outperform projections and become better funded sooner than expected. If there is any way to restore benefits in the future, the Trustees will do so.

Under MPRA, no participant can have his or her benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

The calculation of the PBGC guaranty is complicated, as it considers both the years of service that have been worked and rate of benefit accrual that the Fund has credited. The maximum monthly benefit the PBGC will guarantee is $35.75 for each year of service that has been earned. Thus, for participant with 30 years of service, the maximum PBGC guarantee is $1,072.50 per month. 110% of this amount is $1,179.75.

The PPP’s benefit reductions are permanent reductions, and the PPP does not have an expiration date. As mentioned earlier, the Trustees are required to review the Fund’s status every year to determine whether the PPP’s benefit reductions are still necessary. It is possible – although unlikely – that the Fund could outperform projections and become better funded sooner than expected. If there is any way to restore benefits in the future, the Trustees will do so.

Yes. All Fund participants, including union officials and Trustees (if they are participants in the Fund) are subject to the same benefit reductions under the PPP.

The PPP will have no effect on the Health Fund. The Health Fund is a separate benefit fund which provides health-related benefits. The Health Fund is in good financial condition.

No. In order to be considered an Active Participant under the PPP, you cannot have retired before July 1, 2017. An Active Participant must meet both of two criteria: (1) not retired and not entered pay status as of July 1, 2017; and (2) have at least 500 hours of employer contributions paid to the Fund on his or her behalf in 2015, 2016 or 2017.

The benefit reduction is 20% for all Active Participants.

The reduction for Active Participants is based on the participant’s accrued benefit as of July 1, 2017.

Yes. The 20% benefit reduction applies equally to all participants that meet the definition of Active Participant on July 1, 2017, regardless of years of service up to that date.

Yes. The 20% benefit reduction applies equally to all participants that meet the definition of Active Participant on July 1, 2017, regardless of the form of pension benefit selected.

Yes. Active Participants will continue to earn additional monthly benefits by continuing to work after July 1, 2017, based on the applicable Rehabilitation Plan Schedule. Under the PPP, additional monthly benefits earned after July 1, 2017 will not be subject to reductions.

Active participants will continue to accrue benefits after July 1, 2017 based on the applicable Rehabilitation Plan Schedule.

No. If you retired prior to July 1, 2017, you will not be considered an Active Participant under the PPP regardless of whether you return to work.

No. The early retirement provisions provided under the various Rehabilitation Plan schedules (i.e. 55 &30) remain unchanged.

The Treasury’s model notices require the Fund to provide the estimated impact of the PPP on your full accrued benefit as of the Fund’s latest valuation date and payable at your Normal Retirement Age (65). Therefore, the estimate reflects your full accrued benefit and earned Credited Service as of January 1, 2016 and does not assume any additional contributions are remitted to the Fund on your behalf. This is similar to the Personal Benefit Statements you have received over the years. Those Statements show your accrued benefit and earned Credited Service as of the date on the Statement, and tell you what your pension would be at your Normal Retirement Age if you did not earn any additional Credited Service.

As always, if you would like to see an estimate of your projected benefit at an earlier age than your Normal Retirement (65), please write to the Fund Office with the specific dates for which you would like to see an estimate.

The benefit reduction is 31% for all Non-Active Participants, which includes retirees.

The reduction is based on the retiree’s monthly benefit amount as of July 1, 2017.

The Trustees thoroughly considered a number of factors as they developed the PPP. The PPP calls for larger reductions for Non-Active Participants for a number of reasons. First, the Fund will not survive – regardless of the PPP – unless it is able to keep Active Participants and their employer contributions in the Fund. The Trustees believe that reducing benefits for Actives by more than 20% will cause more employers and bargaining unit groups to leave the Fund, which has been happening at an alarming rate over the last decade as contribution rates have steadily increased and the Fund has had to reduce benefit accruals.

Second, the active population has already incurred several benefit reductions over the last 12 years. Prior to the passage of MPRA, federal law prohibited the reduction or modification of retiree benefits. This meant all pension reductions required to address any funding issues fell exclusively upon the Active Participants. In 2004, the Fund reduced the accrual rate from 2.6% to 1.3% for Active Participants. Then, under the Rehabilitation Plan effective January 1, 2011, the Trustees reduced the accrual rates to a range of 1.0% to 0.25%, depending on the applicable Rehabilitation Plan Schedule and eliminated most adjustable benefits. The Trustees believe these prior cuts must be reflected in the decision concerning the proposed PPP reductions. For this reason, the Trustees decided against reducing Active Participants’ benefits as much as others.

Under MPRA, participants who are age 80 or older as of July 31, 2017 (the last day of the month in which the PPP goes into effect) will not have their benefits reduced.

Yes. If you attain age 80 on or before July 31, 2017, your pension will not be reduced.

MPRA provides for partial age-based protections for participants who are ages 75-79 as of July 31, 2017.

Participants who are at least 75 but less than 80 as of July 31, 2017, are partially protected from reductions. The amount of the reduction is determined on a sliding scale based on age and the amount of the participant’s preliminary (non-age adjusted) benefit reduction as indicated in the following formula:

For example, a participant who is age 77 years and 6 months on the last day of the month of the Fund’s PPP effective date, July 31, 2017, would have two years and 6 months (30 months) until the age of 80. As a result, this participant’s proposed pension benefit reduction would be limited to 50 percent (30 months/60 months) of what the reduction would otherwise be without the age protection. The reduction without the age protection would be 31%, so the reduction with the age protection would be 15.5% (31 x 50%).

The age-based benefit protections are legally mandated by MPRA. The Trustees have no discretion in applying them.

The age-based protections are based on your age as of July 31, 2017. If you turn age 75 on or before July 31, 2017, your benefit will be reduced in accordance with the sliding scale described above. If you turn age 75 after July 31, 2017, you will receive the full 31% reduction, and the reduction will remain in place permanently. Benefits will not be restored as retirees age after July 31, 2017.

No. If you retire and become a Non-Active Participant as of July 1, 2017, then you will be subject to the Non-Active Participant benefit reduction (31%).

If you are still working in covered employment and satisfy the requirements to be an Active Participant under the PPP on July 1, 2017, then you will be subject to the Active Participant benefit reduction (20%).

A participant who has not yet retired and entered pay status, and who has not had at least 500 hours of employer contributions submitted to the Plan on his or her behalf in the 2015 Plan Year, in the 2016 Plan Year, or in the 2017 Plan Year by July 1, 2017 is considered a Terminated Vested Participant.

The PPP proposes a 31% benefit reduction for all Non-Active Participants, which includes Terminated Vested Participants.

The reduction is based on the Terminated Vested Participant’s accrued benefit as of July 1, 2017.

No. Whether you are an Active Participant or Non-Active Participant is determined based on your status as of July 1, 2017. If you return to work in 2017 and work at least 500 hours in covered employment prior to July 1, 2017, you would be considered an Active Participant. If you do not have 500 hours of covered employment in 2015, 2016 or prior to July 1, 2017, you would be considered Non-Active as of July 1, 2017.

Any Non-Active Participant who has been legally designated by a participant, the Fund, or by law to become entitled to a pension benefit from the Fund as of July 1, 2017.

The benefit reduction is 31% for all Non-Active Participants, which includes Beneficiaries.

The benefit reduction for all Non-Active Participants, including Beneficiaries, is based on the Beneficiary’s monthly benefit amount as of July 1, 2017.

Yes. If your spouse survives you, your spouse at the time of retirement continues to be entitled to the Survivor Benefit upon your passing. However, the amount of the Survivor Benefit may be reduced in accordance with the PPP, subject to certain limitations discussed below.

Yes. As your benefit is reduced under the PPP, the cost of providing a lesser Survivor Benefit is also reduced proportionately. For example:

| Prior to PPP | After PPP |

| $2,175.38 Accrued Benefit | $1,501.01 (Less 31%) Accrued Benefit |

| ($175.38) 50% J&S Reduction | (121.01) 50% J&S Reduction |

| $2,000.00 Monthly Benefit |

$1,380.00 Monthly Benefit |

| $1,000.00 Survivor Benefit |

$690.00 Survivor Benefit |

But, in no event, can your spouse have his or her survivor benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

No. Unfortunately, the law does not permit a change in your benefit option selection once you have retired.

Although it might seem unfair that your benefit is being reduced by the same percentage as a retiree who is receiving a single life annuity, your benefit will be paid over the course of two lives: yours and your spouse’s. The reductions proposed in the PPP are designed to keep the Fund solvent. If the PPP proposed lesser reductions for retirees receiving a survivor’s annuity, the percentage reductions for the other categories of participants would have to be increased. That would be inequitable given that your pension is being paid over the course of two lives.

Yes. Because both of you will be over age 75 on July 31, 2017, the age-based protection will apply. Age-based protections are based on either your age, or your spouse’s age, as of July 31, 2017. If you are alive on July 1, 2017, the age-based protection will be based on your age. If you are not alive on July 1, 2017, the age-based protection will be based on your spouse’s age as of July 31, 2017. In no event, however, will your spouse have his or her survivor benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

Yes. Because you are alive on July 1, 2017 and will be over age 75 on July 31, 2017, your pension will be at least partially protected. When you die, your spouse will receive the applicable percentage of the partially protected benefit you were receiving prior to your death (either 50%, 75%, or 100%, depending on the type of J&S you selected). In no event, however, will your spouse have his or her survivor benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

No. If you die prior to July 1, 2017, any age-based protections are based on your spouse’s age as of July 31, 2017. Because your spouse is under age 75, he or she will receive a 31% reduction to his or her survivor’s benefit. In no event, however, will your spouse have his or her survivor benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

No. Because you are under age 75 on July 31, 2017, your pension will be reduced by 31%. If you die after July 1, 2017, your spouse will receive the applicable percentage of the benefit you were receiving prior to your death (either 50%, 75%, or 100%, depending on the type of J&S you selected). In no event, however, will your spouse have his or her survivor benefit reduced below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

Yes. If you die prior to July 1, 2017, any age-based protection will be based on your spouse’s age as of July 31, 2017. Because your spouse is over age 75 on July 31, 2017, the age-based protection will apply.

Since your spouse (the participant) died prior to July 1, 2017, any age-based protection is based on your age (as the beneficiary) as of July 31, 2017. Even if your spouse was under age 75 when he/she died, the age-based protections will apply because you will be age 75 or over on July 31, 2017.

No. Your spouse’s benefit would have been protected because he or she was over age 75. However, because he or she is deceased, applicability of the age-based protections is determined based on your age as of July 31, 2017. Because you are under age 75, the full 31% reduction will apply.

An orphan participant is someone who worked for a contributing employer that withdrew from the Fund and did not pay its full withdrawal liability. Companies often withdraw from the Fund because they are going out of business or filing for bankruptcy, among other reasons. When this happens, the Fund is very aggressive in attempting to collect the employer’s full withdrawal liability. In many cases, however, the Fund is not able to collect some or any of the withdrawal liability because the withdrawing company has little or no assets. In those cases, the employees who worked for one of these companies have already been granted pension credit, but the future benefits related to that credit were not fully paid for. The pension credit earned with an employer that did not pay its full withdrawal liability is considered orphan service credit.

Federal law requires the Fund to give pension credit based on the contributions required (whether or not received), and does not permit pension credit to be conditioned on an employer’s payment of withdrawal liability.

No. Under the PPP, orphans will not be treated differently and will be subject to the same proposed benefit reductions as all other participants.

The Trustees considered treating orphans differently under the PPP, but decided not to do so for several reasons. First, MPRA requires that all benefit reductions under the PPP be “equitably distributed” across all participants. Because current legal guidance does not permit treating orphans as a separate class of participant, the Trustees did not believe larger cuts for orphans would be legally permissible. Second, employees generally have no involvement in an employer’s decision to withdraw from the Fund. It is usually a business decision over which the employees have no control. Third, most companies that withdraw do so because they are going out of business and/or filing for bankruptcy. When an employer goes out of business or files bankruptcy, they often do not pay the full amount, or any, of their withdrawal liability. The Trustees recognized that orphans had no ability to control whether their employer went out of business or failed to pay the full assessed withdrawal liability. For these main reasons, the Trustees decided that it would be unfair to impose bigger reductions on orphans.

No other pension fund that has applied for pension benefit reductions under MPRA has proposed treating orphans differently. The one exception is the Central States Pension Fund, and there is a special provision in MPRA that only applies to Central States in order to address the special circumstances of UPS’s withdrawal.

The PPP treats Active Participants differently from retirees, beneficiaries and other participants for a number of reasons. First, the Trustees recognized that the Fund will not survive unless it retains its Active Participant population and their corresponding contributions from financially viable employers that can maintain participation in the Fund. As history has shown, without the support of Active Participants, employers will continue to withdraw from the Fund, and the Active Participants will look for higher wages and other retirement options with non-contributing employers. The Trustees believe a larger reduction for Actives will cause the loss of more participants.

Second, the Trustees noted that the Fund has subjected the Active Participants to numerous benefit reductions and eliminations since 2004, including a 50% reduction in future accruals in 2004 and the elimination of most of the adjustable benefits and early retirement subsidies under the Rehabilitation Plan. In considering these prior reductions, the Trustees compared the relative impact on active and retiree benefits and determined that on average, the proposed reductions result in similar pension amounts for both Active Participants and other participants.

Here are comparisons as an example:

As these examples show, although the reduction for Active Participants is smaller than the reductions for other participants, the actual pension amounts are quite similar because of the effect of the prior reductions imposed on Active Participants.

The Trustees also considered the savings to the Fund from the various benefit reductions, and found that Active Participants and retirees overall were contributing roughly the same amount to the total savings in liability to the Fund. In other words, if you take the savings resulting from the previous benefit reductions to Active Participants under the Rehabilitation Plan, plus the savings from the proposed 20% reduction, those savings are about the same as the savings resulting from the proposed 31% reductions for retirees and beneficiaries (and this does not even include the 50% future accrual reduction in 2004).

When looking at all these factors, the Trustees believe that proposing a lesser benefit reduction of 20% for Active Participants was not only the correct decision, but was equitable, as required by MPRA.

No, the pop-up feature has not been eliminated. If your spouse pre-deceases you, your pension amount will be increased (i.e. “pop-up”) to the amount you would have received as a single life annuity, but subject to reduction. For example:

Prior to PPP After PPP

$2,175.38 Accrued Benefit $1,501.01 (Less 31%) Accrued Benefit

($175.38) 50% Joint & Survivor Reduction (121.01) 50% Joint & Survivor Reduction

$2,000.00 Monthly Benefit $1,380.00 Month Benefit

$1,000.00 Survivor Benefit $690.00 Survivor Benefit

If your spouse in the above example pre-deceases you, the pension amount will “pop-up” from $1,380 per month to $1,501.01 per month, which is the amount you would have received based on your Accrued Benefit after application of the 31% reduction.

The law requires the Fund to reduce benefits to an extent that will allow the Fund to project that it will remain solvent into the future; this generally means for at least the next 30 years. Based on the Fund’s current financial condition, in order for the Fund to project solvency this far into the future, the benefit reductions are presumed to last forever. However, the law also requires the Trustees to review the Fund’s overall financial condition on an annual basis and determine if the benefit reductions are still required. That is because projections are educated estimates of what the Trustees, based on the recommendations of the Fund professionals, think might happen in the future based on conditions that exist today. Projections are not always 100% accurate. Thus, if the Fund’s actual experience is better than the projections, it is possible that the Trustees will be able to restore some or all of the pension benefits. For example, if investment returns are much higher than projected, or if the Fund’s active participant base grows much greater than projected, such experience will have a positive impact on the Fund’s financial condition. Given the current status of the Fund, however, a benefit restoration is unlikely in the near term. Nevertheless, the Trustees will be reviewing the Fund’s financial condition very carefully, and if there is an opportunity to restore or partially restore benefits and still project long-term solvency, they will consider doing so.

Approximately 72% of the Fund’s participant population is subject to some level of benefit reductions.

Approximately 39% of participants are subject to the full reductions.

Approximately 28% of participants are exempt from any reduction because MPRA requires protections for certain categories. There can be no reduction of benefits for participants who are (1) over the age of 80 as of July 31, 2017; or (2) receiving a disability pension from the Fund. The law also limits the amount of benefit reductions for participants who are between age 75 and 80 as of July 31, 2017, and also does not allow for reductions below 110% of the amount the PBGC would guarantee if the Fund were to become insolvent.

Approximately 33% of participants have benefits that are partially protected because of the age and guarantee restrictions described above.

To date, eight other Funds have applied to Treasury for approval of benefit reductions. Treasury has already denied the Central States Pension Fund and the Road Carriers Local 707 Pension Fund’s reduction application.

Treasury is currently reviewing the applications of:

(1) Teamsters Local 469 Pension Fund – the application requires a 45% reduction for all participants

(2) Ironworkers Local 16 Pension Fund – the application requires reductions of up to 50%, based on years of service for all participants

(3) Iron Workers Local 17 Pension Fund - the application requires a recalculation of benefits for all participants and application of early retirement reductions for previously subsidized benefits

(4) Bricklayers Local 5 Pension Fund – the application requires reductions to 110% of the PBGC guarantee amount (the maximum amount allowed under MPRA) for all participants

(5) Bricklayers Local 7 Pension Fund – the application requires reduction to 1.3% of contributions.

(6) United Furniture Workers Pension Fund - the application requires reductions to 110% of the PBGC guarantee amount (the maximum amount allowed under MPRA) for all participants

Additional pension plans will likely file applications with Treasury in the future. Treasury maintains a list of all plans that have applied for benefit reductions on its website.

Within the 30 days after the filing of the application (August 31), Treasury will put the Application on its website and provide you with an opportunity to comment on the Application. You can submit comments online. The link to the Application can be found at: http://www.treasury.gov/services/Pages/Plan-Applications.

Since 1991, the Pension Fund has returned over 700%, or 8.5% per year, net of fees.

Yes. Like stock and bond markets, the Pension Fund has rebounded since the market corrections of 2002 and 2008. Since 2002, global stock and bond markets have returned 7.3% per year, or 168%. Over that same period, the Fund has returned 169%. Since the bottom of the market in March 2009, the Fund has had strong returns, outperforming global stock and bond markets, and returning 120%, or 11.0% per year, while the global markets have returned 106%, or 10.0% per year.

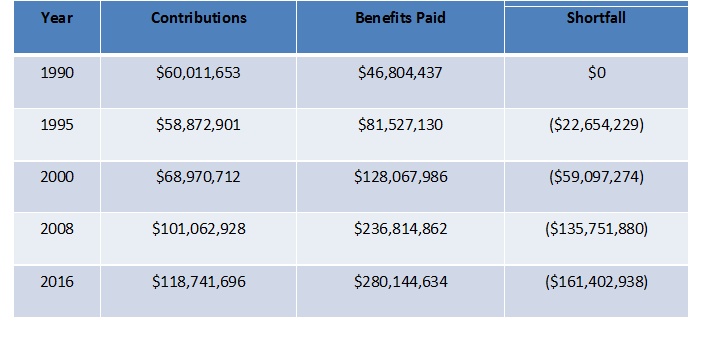

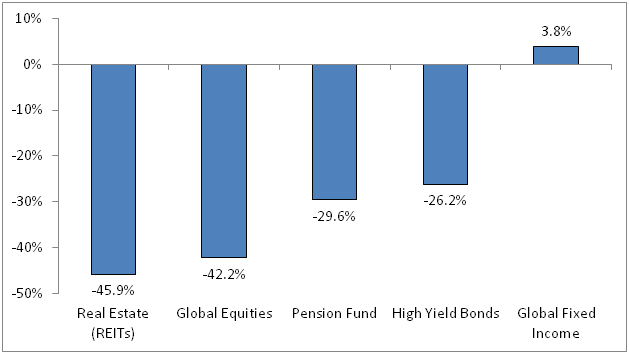

Even with the rebound, the huge market losses of 2002 and 2008 continue to have a big impact on the Fund. In 2008, the Fund lost $822 million in total asset value, with the investment losses accounting for $617 million, or 29.6% of its total assets. The strong returns since then – averaging 11% per year – helped recoup the losses, but the Fund has had to withdraw large amounts from investments each year in order to make benefit payments. Year after year, the Fund is paying out more in benefits than it is taking in from employer contributions. In 2016, the Fund paid about $280 million in benefits, but received only about $119 million in contributions. That’s a shortfall of about $161 million for 2016 alone, and that annual shortfall gets larger each year. To put it into perspective, the Fund has paid out since 2009, $1.18 billion more than it has taken in.

The main issue is that the Fund is paying out more than it is taking in every year. There has been a big drop in employer contributions, and this is mostly because of the decline in the number of contributing employers, many of whom were unable to pay their withdrawal liability. Unionized employment in general has declined, and it was even worse for the trucking industry, which has always been a large portion of the Fund’s participants. Following deregulation of the trucking industry in the 1980s, the Fund lost more than 600 contributing employers and tens of thousands of participants. The loss of participants, as well as the difficulty attracting new and financially stable contributing employers to the Fund, means older workers are retiring without being replaced with enough new employees. As a result, there are more retirees getting pensions than active participants. This imbalance has resulted in the Fund paying approximately $280 million per year in benefits, but only receiving approximately $119 million in contributions. It is estimated that it would take an investment return of approximately 13.5% every year just to cover the shortfall between contributions and benefit payments. It is impossible to expect that type of annual return. And, because the contributions to the Fund have gone down, the Fund relies more heavily on investment earnings to make up the gap. But, as the Fund’s assets continue to shrink, it means there is less money to invest. Unfortunately, less money to invest means less money is earned even if investment returns are strong.

Yes. Most people with 401(k) plans continue to make contributions to their accounts each month (or annually), and do not make monthly withdrawals. This means that most 401(k) plans experience positive cash flow (more money comes in than goes out). Over time, when there are no withdrawals, the continuation of contributions, together with positive investment performance, eventually allows a 401(k) plan account to make up for past investment losses. The Pension Fund is in the opposite situation; it makes monthly withdrawals (benefit payments) that far exceed the amount of contributions that come in, resulting in negative cash flow each year. Because the negative cash flow is so large, even positive investment returns over a period of many years is not sufficient to preserve the Fund’s assets.

The reason the Pension Fund hasn’t recovered is because of its negative cash flow. For example, if a 401(k) or personal investment account lost 30% of its value like the Pension Fund did in 2008, you could eventually recoup those losses with positive investment returns. Now think of what your 401(k) or personal investment account would look like if it lost 30% of its value and you also were withdrawing 10-15% of the balance each and every year. Even if you were getting great returns on your investments, the account balance would continue to shrink because of the withdrawals. This is what is happening with the Pension Fund, as net cash flows are negative. Every month, the Fund withdraws from investments in order to pay benefits. This not only means investment returns must make up for the withdrawals, it also means there is less in investments from which to make returns. Using an example with real numbers, say a 401(k) account has $100,000, and it lost 30% due to a market drop, there would be $70,000 left. If every year after that the 401(k) earned 10%, the $30,000 loss could be made up in a little less than 4 years. However, if in addition to losing $30,000, you also were forced to make annual withdrawals of $10,000 per year, investment earnings of 10% would not be enough to make up for the withdrawals. Instead of making up the $30,000 loss, the account balance would continue to go down until there was nothing left. This is the situation the Pension Fund is in.

The Fund has about twice as many retirees as actives. The difference in the number of retirees and actives has continued to increase each year since the early 1990s. This means there are less contributions being received than benefit payments going out every month. This is true even though contribution rates have increased every year. In 1990, the Fund received approximately $60 million in contributions, and paid out approximately $47 million in benefits. By 2016, the Fund was receiving almost $119 million in contributions, but paid out a little more than $280 million in benefits. The chart below shows how fewer actives and an increasing number of retirees has turned the Fund’s cash flow increasingly negative.

Every major asset class had negative returns in 2008, with the exception of investment grade bonds. It was the worst economic collapse since the Great Depression. Any investor with long-term investments that included equity (stocks) faced significant losses in 2008.

The only way any investor could have gotten a positive return in 2008 would have been to invest close to 90% of assets in investment grade bonds. However, the Fund couldn’t do that. The Fund is legally required to diversify investments, which means the investment must be made across many different types of investments and asset classes. In addition, most investment experts agree that the way to minimize large losses is to have a well-diversified portfolio. The old adage “don’t put all your eggs in one basket” is especially true when it comes to long-term investing. Generally, when certain asset classes are experiencing investment gains, there are other asset classes that are experiencing losses. The goal is to not have all your assets invested solely in those classes that are experiencing losses. If you spread the assets across many different asset classes, there is a much smaller chance of incurring large losses. However, during the historic market downturn of 2008-2009, almost all asset classes suffered losses. Therefore, although the Fund had a well-diversified portfolio, the Fund still suffered major losses.